06 – The most "innovative" companies don't innovate — they buy.

Selling or buying? Today, I explore how acquisitions can be a game-changing strategy for startups, consultancies and small businesses to accelerate growth, scale capabilities, and stay competitive.

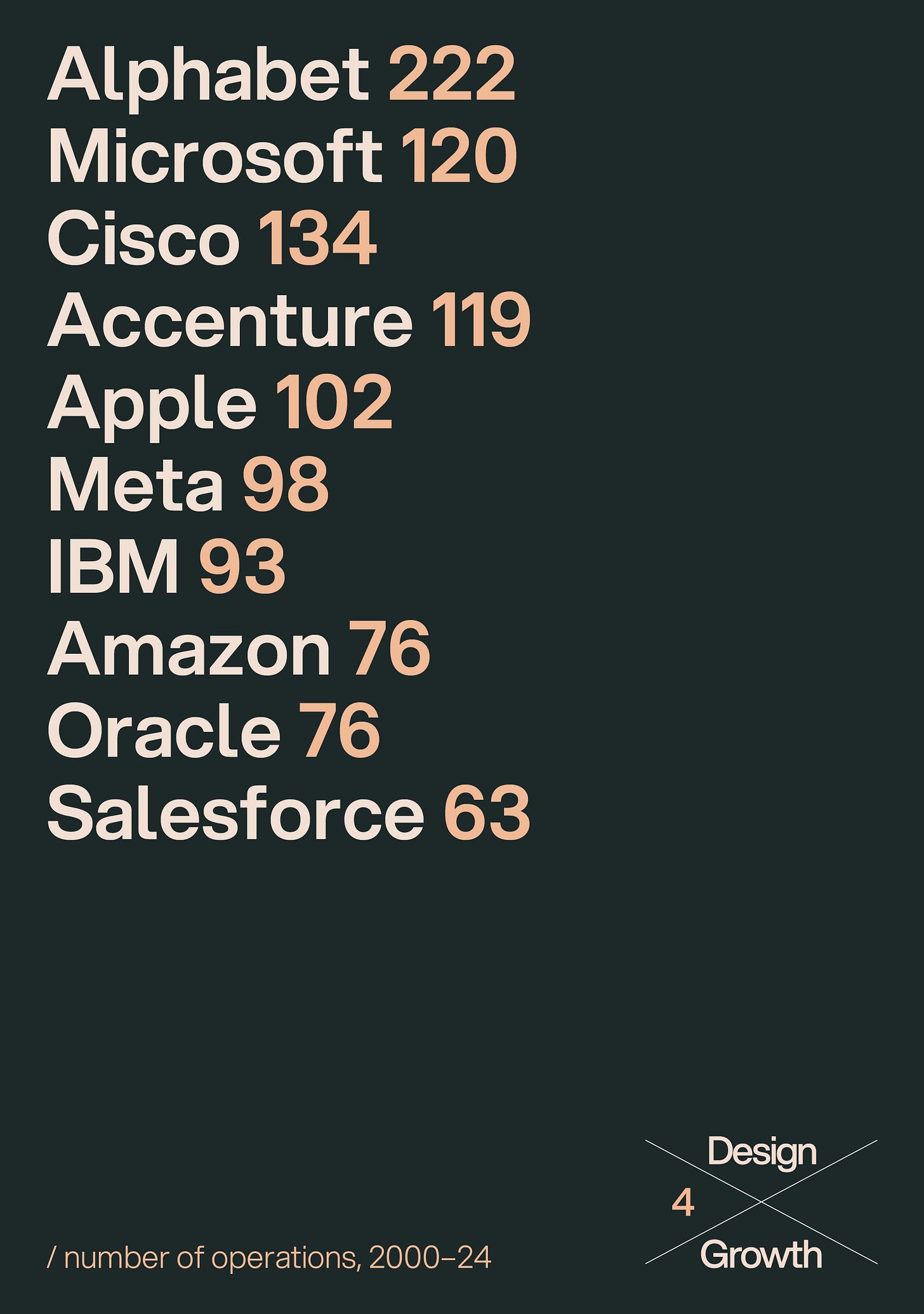

Source: Crunchbase

Issue 6 — Madrid, 12th December 2025

The tech world’s most closely guarded secret? The most "innovative" companies don't innovate — they buy. Alphabet’s 222 acquisitions, Tesla’s empire built on 9 strategic buys — the story is clear. Silicon Valley didn’t build its dominance through invention alone but through acquisition.

This playbook isn’t just for tech giants. It’s a blueprint that startups, agencies, and growth-driven businesses can use to scale smarter, faster, and with less risk.

Big Tech buys its way to the top by filling gaps, acquiring customers, and scaling fast. For startups and small businesses the principles are the same but on a more accessible scale:

Strategic Acquisition: Buy smaller, complementary businesses that fill gaps in your service offering or market presence.

Immediate ROI: Start with businesses that already generate cash flow and come with loyal customers.

Talent and Resources: Acquire teams with expertise instead of building from scratch. Leadership is in short supply.

WHY THIS WORKS IN THE CONSULTANCY AND AGENCY WORLD

Unlike B2C or product-based companies, consultancies and agencies take years, even decades, to build a strong reputation and portfolio. Acquiring a well-established name can accelerate this process significantly.

Consultancies and agencies can leverage acquisitions as a strategic approach to rapidly grow their portfolios and capabilities. This tactic enables them to evolve at a pace that organic growth alone often cannot match.

Accenture serves as a prime example, having transformed into the world's largest creative powerhouse by acquiring over 60 agencies and design firms in just a decade. Notable acquisitions such as Fjord, a design and innovation consultancy, and Droga5, a world-renowned creative agency, have bolstered Accenture’s offerings, expanded its global reach, and diversified its client base.

For smaller consultancies and agencies, adopting a similar strategy—albeit on a more modest scale—can provide significant benefits:

Expanding into New Markets

Acquisitions can enable immediate entry into new regions, industries, or verticals, bypassing the time and resources needed to establish a foothold independently.Enhancing Service Offerings

Gaining specialized capabilities through acquisitions allows companies to offer new services without building expertise from scratch.Accessing New Clients

Acquired firms often come with an established client base, opening doors to new business opportunities.Gaining a Competitive Edge

In an increasingly crowded and competitive marketplace, acquisitions provide a means to stand out by offering more comprehensive or unique services.Ensuring Survival

With high competition and rising operational costs, acquisitions can be a lifeline, enabling smaller firms to remain viable by scaling their operations and resources.

This approach, while transformative, comes with its challenges—particularly for smaller firms. The costs and risks associated with acquisitions can be significant, requiring careful planning and integration to ensure success. However, when executed effectively, this strategy can position firms to not only survive but thrive in a competitive industry landscape.

Brian Whipple (left), Global CEO of Accenture Interactive, and David Droga (right). Accenture's $475 million acquisition price highlights a challenging EBITDA multiple indexes.

A WAKE-UP CALL FOR STARTUPS AND SCALE-UPS

For startups and product-based companies, the idea of scaling through acquisitions is becoming a game-changer. While many startups envision disruption and market leadership, they often find themselves stuck chasing acquisition offers instead of positioning themselves as potential buyers. By adopting an acquisition strategy, startups can move beyond mere survival and aim to dominate their niche.

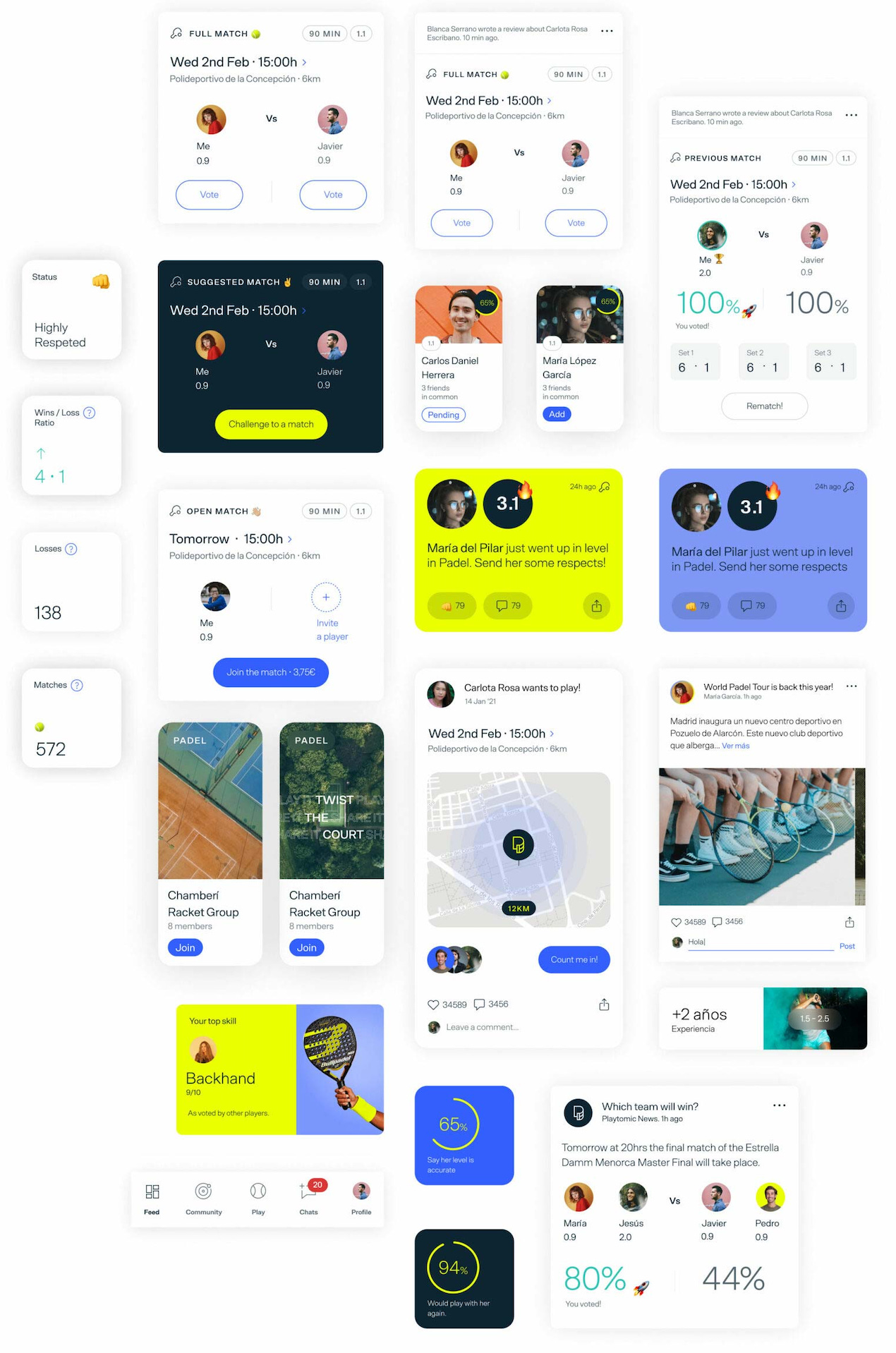

Pedro Clavería, co-founder of Playtomic, Europe's first Sportech unicorn, highlights that the company didn’t begin from scratch but scaled rapidly through strategic acquisitions.

To accelerate its growth, Playtomic revamped its strategy, branding, and digital product with my agency, Erretres. This transformation included launching new revenue models like subscriptions, creating an apparel brand, and empowering the community. You can explore the full case here: Playtomic App.

Playtomic's strategy, brand and product design, crafted by Erretres – The Strategic Design Company.

To date, Playtomic has completed five acquisitions, including key companies like SportClubby and Kourts, Inc., expanding its footprint in Europe and the U.S. These moves have helped Playtomic dominate the racket sports market by consolidating booking systems and significantly growing its user base and market share.

Startups that follow this path can leverage acquisitions in several ways:

Acquiring Technology

Rather than spending years developing proprietary tech from scratch, startups can acquire proven technology that accelerates their product development and enhances their offerings.Attracting Talent

Acquiring companies often comes with the benefit of talented teams. By purchasing a business, startups can gain instant access to skilled professionals who can drive innovation and growth.Gaining Market Share

Acquisitions allow startups to expand their customer base and market presence quickly. Instead of competing for the same clients, they can absorb competitors and broaden their reach almost overnight.Becoming a Market Leader

The ultimate goal for many startups isn’t just to survive in a competitive market but to dominate it. By acquiring strategic assets—whether it’s tech, talent, or customers—startups can position themselves as the go-to players in their niche.Scaling Faster

Scaling organically takes time, but through acquisitions, startups can leapfrog several stages of growth, enabling them to scale faster and more efficiently.

For startups looking to accelerate their growth, the message is clear: acquisitions aren’t just for established companies—they can be a powerful tool for startups to scale, innovate, and ultimately become leaders in their industry. The key is not just to disrupt, but to strategically position yourself as a buyer, transforming the market landscape from the inside out.

Source: Crunchbase

ARE YOU BUYING OR SELLING?

Acquisitions can be a powerful tool for growth, but they come with challenges and trade-offs depending on the buyer or seller. Understanding the nuances of each type of acquirer—whether it's a consultancy, IT giant, advertising group, or competitor—is critical to making the right decision for your business. Remember, the right partner not only pays well but aligns with your vision, culture, and long-term goals.

If dealing with Big 4 or consultancy companies:

— Sellers: Negotiate to secure upfront payment and protect key team members from being sidelined. Be realistic about cultural misalignment and focus on roles post-sale.

— Buyers: Be clear about the strategic value the acquisition brings beyond revenue. Avoid acquisitions solely for in-house capabilities if integration challenges loom.

If dealing with Big IT consultancies:

— Sellers: Capitalize on higher multiples but insist on preserving your brand's identity and operating model for the transition period. Watch for signs of cannibalization.

— Buyers: Ensure you don’t erode the acquired team’s value by diluting their expertise with internal teams. Keep their brand as a trust signal to external markets.

If dealing with competitors:

— Sellers: Prioritize cultural and strategic fit. Accept partial equity deals if the buyer’s vision aligns with yours and promises long-term growth.

— Buyers: Use the shared industry context to create a seamless integration. Be upfront about brand and operational changes to maintain trust and morale.

By taking the time to evaluate the cultural, financial, and strategic fit of any deal, both buyers and sellers can ensure they’re not just closing a transaction—but building a future.

A SMARTER PLAYBOOK

When considering the future of your business, ask yourself: are you building to sell or building to lead? Your answer will shape your strategy. Leveraging strategic partnerships is key, particularly through acquisitions that align with your vision. These moves can strengthen your position, expand your capabilities, and drive sustainable growth.

Acquisitions aren’t just for industry giants; even small-scale investments can yield exponential results for smaller businesses. Whether you’re a startup founder or agency leader, the landscape has shifted. The question is no longer if you should embrace acquisitions as a growth strategy, but whether you’ll lead the charge or risk being left behind.

Adaptability and proactive decision-making are essential in this evolving game.

Stay bold. Move fast.

See you next Thursday, 1PM Brussels time.

My projects:

www.design4growth.net

www.erretres.com

www.erretresopenlab.com

www.nordic-bikes.com

Upcoming Newsletters:

Knowing When It’s Time to Let Go of Clients

Why I Didn’t Sell My Agency for Seven Figures

Why founders need to show up daily

Balancing Company Leadership with a Healthy Lifestyle

Building an Audience While Creating a Product

How I sold a project using the word "f*ck" 7 times in a 7-slide presentation

Embracing Remote Work: Building a Remote-First Culture

How to craft a MASTERPLAN (exclusive content for paid members)

Every Thursday at 1 PM, directly to your inbox.